The Turnagain Project, located in north-central British Columbia on the traditional territory of the Tahltan and Kaska Dena, and is among the largest undeveloped sulfide nickel deposits in the world. Turnagain is held in Hard Creek Nickel, a subsidiary owned jointly by Giga Metals Corporation and Mitsubishi Corporation. Read the Pre-Feasibility Study press release here and the full PFS report here.

Highlights

|

Desirable Product |

Nickel sufhide concentrate |

|---|---|

|

Multiple Potential Product Paths |

Smelters or Pressure Oxidation Circuit to Class 1 nickel |

|

Typical Annual Output |

37,288 t/y Nickel + Cobalt |

|

Project Life |

30 years |

|

Excellent Product Quality Cobalt adds battery metal byproduct value |

18% Ni 1.1% Co |

|

Simple flowsheet |

Crush – grind – froth flotation |

|

Low Carbon Footprint |

<1.8 t CO2/t Ni (at site gate) |

|

Site Operating Costs (Y3-28 avg.) |

US$3.85/lb (at site gate, before byproduct credits) |

|

Initial Capital Cost |

US$1.9B |

|

Capex per annual tonne of Nickel |

US$58,000 |

|

C1 Cost (Y3-28 avg.) |

US$4.65/lb Ni |

|

IRR (Post-Tax) |

11.4% at US$9.755/lb Ni base case |

|

NPV (Post-Tax) |

US$574 million |

Read the Pre-Feasibility Study Press Release here and the full PFS report here.

Metallurgical Testing

Extensive metallurgical test work has shown that froth flotation can reliably create a high-grade clean concentrate, a very desirable product that can be upgraded to high purity Class One nickel for use in lithium-ion batteries. The cobalt produced is another critical element in battery production, adding to the long-term viability of the resource.

A geometallurgical campaign featuring 70 samples that describe the deposit well (varying location, grade, host rock lithology, etc) and range from high-grade ore to waste is now complete. This campaign demonstrated that all samples fit to a high-precision recovery algorithm that allows Giga to predict the recovery from any given sample with good accuracy. This reduces technical risk significantly by reducing the complexity of modelling compared to deposits which have multiple physical zones that behave differently and/or recovery algorithms with a high degree of scatter. This testwork also showed that even low-grade materials can be cleaned through the flotation process to produce high-grade nickel sulfide concentrate.

Read the Pre-Feasibility Study Press Release here and the full PFS report here.

Mineral Resources and Reserves Statements

Mineral Resource Estimate

The mineral resource released in October 2022 has been updated through revised modeling. The PFS mineral resource is shown below. This resource estimate includes the potentially mineable Horsetrail-Northwest-Duffy and Hatzl zones (north and south of Turnagain River, respectively) and excludes the resources located under the Turnagain River and within an assumed ecological offset boundary. Approximately 95% of the Measured and Indicated Resources lie in the Horsetrail-Northwest-Duffy zones north of the Turnagain River that are the focus of the current mine plan.

Turnagain Nickel-Cobalt Project Mineral Resource Summary1,2,3,4,5

|

Classification |

Tonnage |

Ni Grade |

Co Grade |

Pd Grade |

Pt Grade |

Contained Ni |

|

Measured |

454.6 |

0.215 |

0.014 |

0.023 |

0.022 |

1,020 |

|

Indicated |

1,119.4 |

0.207 |

0.013 |

0.019 |

0.021 |

2,360 |

|

Measured & Indicated |

1,573.9 |

0.210 |

0.013 |

0.020 |

0.022 |

3,381 |

|

Inferred |

1,163.8 |

0.206 |

0.012 |

0.016 |

0.018 |

2,405 |

1. All mineral resources have been estimated in accordance with Canadian Institute of Mining and Metallurgy and Petroleum definitions, as required under National Instrument 43-101.

2. Mineral resources are reported in relation to a conceptual pit shell in order to demonstrate reasonable expectation of eventual economic extraction, as required under NI 43-101; mineralisation lying outside of these pit shells is not reported as a mineral resource. Mineral resources are not mineral reserves & do not have demonstrated economic viability.

3. Open pit mineral resources are reported at a cut-off grade of 0.1% Ni. Cut-off grades are based on a nickel price of $9.00 per pound, nickel recoveries of 60%, mineralized material and waste mining costs of $2.80, along with milling, processing and G&A costs of $7.20.

4. Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorised as mineral reserves. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated.

5. Due to rounding, numbers presented may not add up precisely to the totals provided and percentages my not precisely reflect absolute figures.

The mineral resources are contained in a large, contiguous, near-surface deposit amenable to large-scale open-pit mining techniques. This mineral resource is based on 254 Turnagain area drill holes completed from 2002 through 2021 including both resource and geotechnical drill holes in the ultramafic intrusive.

Mineral Reserves

Mineral reserves have been determined by Tetra Tech based on development of optimized pits following geotechnical guidance from BGC Engineering. Pit optimization was done using the Lerchs-Grossman optimizer in DatamineTM, with PFS metallurgical recovery algorithms and mining, process, G&A, and concentrate shipping and marketing costs. A sustaining capital allowance was added to ensure that the optimized pit respected the cash flow considerations of regular mining equipment replacement and tailings management construction. An offset was applied to the Turnagain River boundary considering modelled flood scenarios for both environmental preservation and infrastructure integrity.

The ultimate pit was developed from optimization of the net present value for nested cone shells respecting the physical and economic constraints including consideration of pit road widths and angles for the recommended mining equipment.

Internal dilution to the large, disseminated ore body is modeled into the block model. Additional dilution and losses have been considered as a 2-metre loss of ore and 2-metre inclusion of waste at the ore-waste interfaces. An additional 1% mining loss was included to account for ore unmined, spilled, and improperly delivered to waste.

The Proven and Probable Mineral Reserves are given below. The mineral resources in the Hatzl zone have not been included in the mine plan and Reserves.

Turnagain Nickel-Cobalt Project Mineral Reserve Summary1,2,3,4,5,6

|

Classification |

Tonnage |

Ni Grade |

Co Grade |

Pd Grade |

Pt Grade |

Contained Ni |

|

Proven |

408.1 |

0.219 |

0.013 |

0.024 |

0.022 |

894 |

|

Probable |

542.4 |

0.194 |

0.012 |

0.020 |

0.022 |

1,055 |

|

Total |

950.5 |

0.205 |

0.013 |

0.022 |

0.022 |

1,949 |

Notes:

1. The Mineral Reserve estimates were prepared with reference to the 2014 Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards (2014 CIM Definition Standards) and the 2019 CIM Best Practice Guidelines.

2. Reserves estimated assuming open pit mining methods.

3. Reserves are reported on a dry in-situ basis.

4. Reserves are based on a nickel price of US $21,500/t, cobalt price of US $58,500/t, ore mining cost of $2.24/t mined, waste mining cost $2.41/t mined, mining sustaining capital of $0.57/t mined, milling costs of $5.35/t ore feed to process plant, TMF sustaining capital of $0.70/t ore feed, and G&A cost of $0.76/t ore feed.

5. Mineral Reserves are mined tonnes and grade including consideration for a 2-m dilution width between ore-waste contact and 1% mining losses.

6. Ore-waste cut-off was based on $6.63/t of NSR.

For a more detailed geological description of the project, read below. Read the Pre-Feasibility Study Press Release here and the full PFS report here.

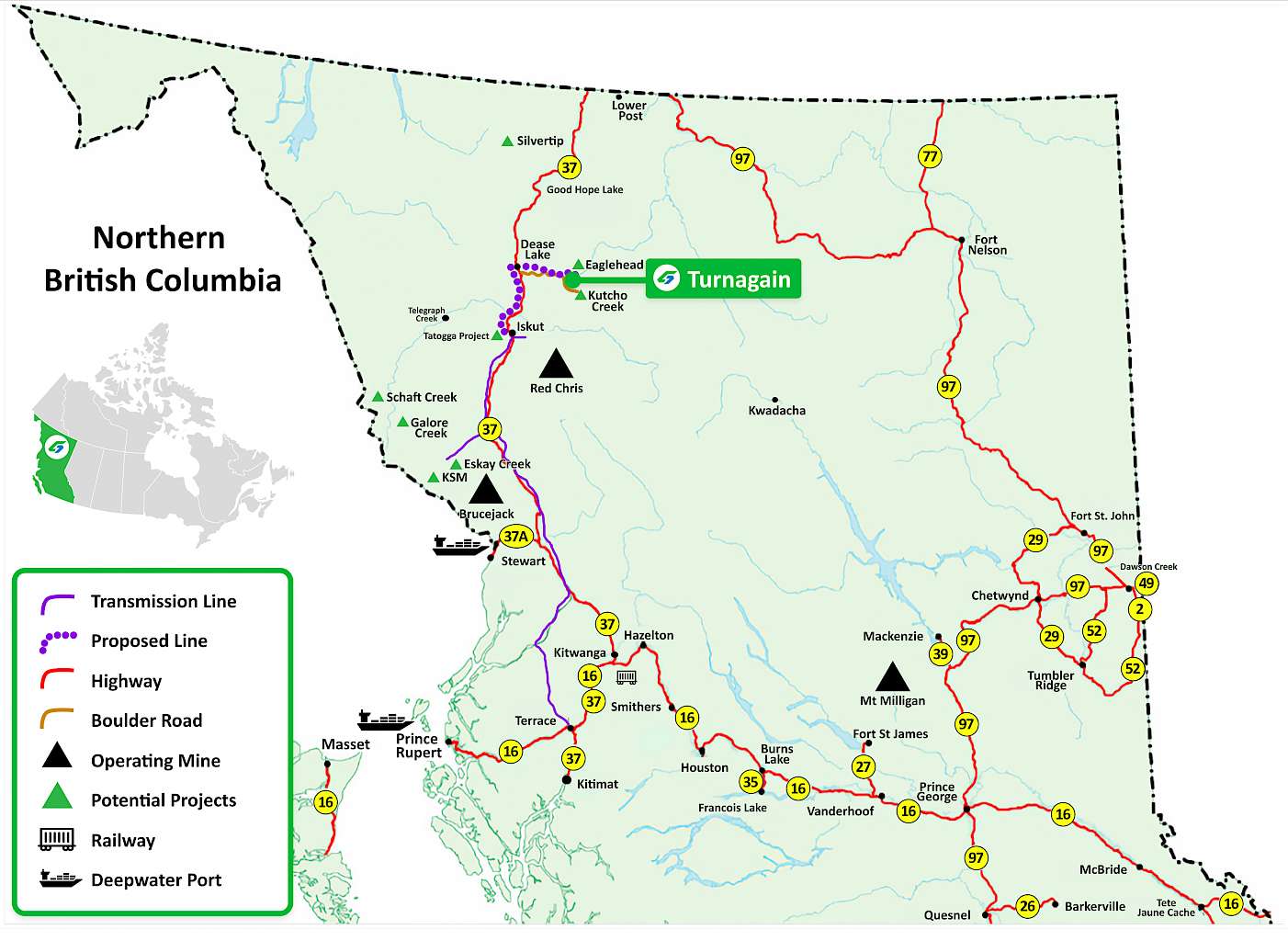

Location

The Turnagain property lies immediately north of the Turnagain River near its confluence with Hard Creek, 65 kilometres east of the community of Dease Lake. Dease Lake is located on Highway 37, some 400 kilometres north of the Port of Stewart. An 80 kilometre access trail extending easterly from Dease Lake extends into the Turnagain property and is used to haul equipment and supplies. A 900 metre long dirt airstrip, expanded in 2008 and situated within the claims area on the north side of Turnagain River, accommodates small aircraft. This airstrip is immediately adjacent to the current camp facility.

Dease Lake offers some supplies and services. The communities of Terrace and Smithers in B.C. and Whitehorse in Yukon are all several hundred kilometres distant and offer the best range of supplies and services which can be flown in by fixed-wing charters or trucked to Dease Lake via Highway 37.

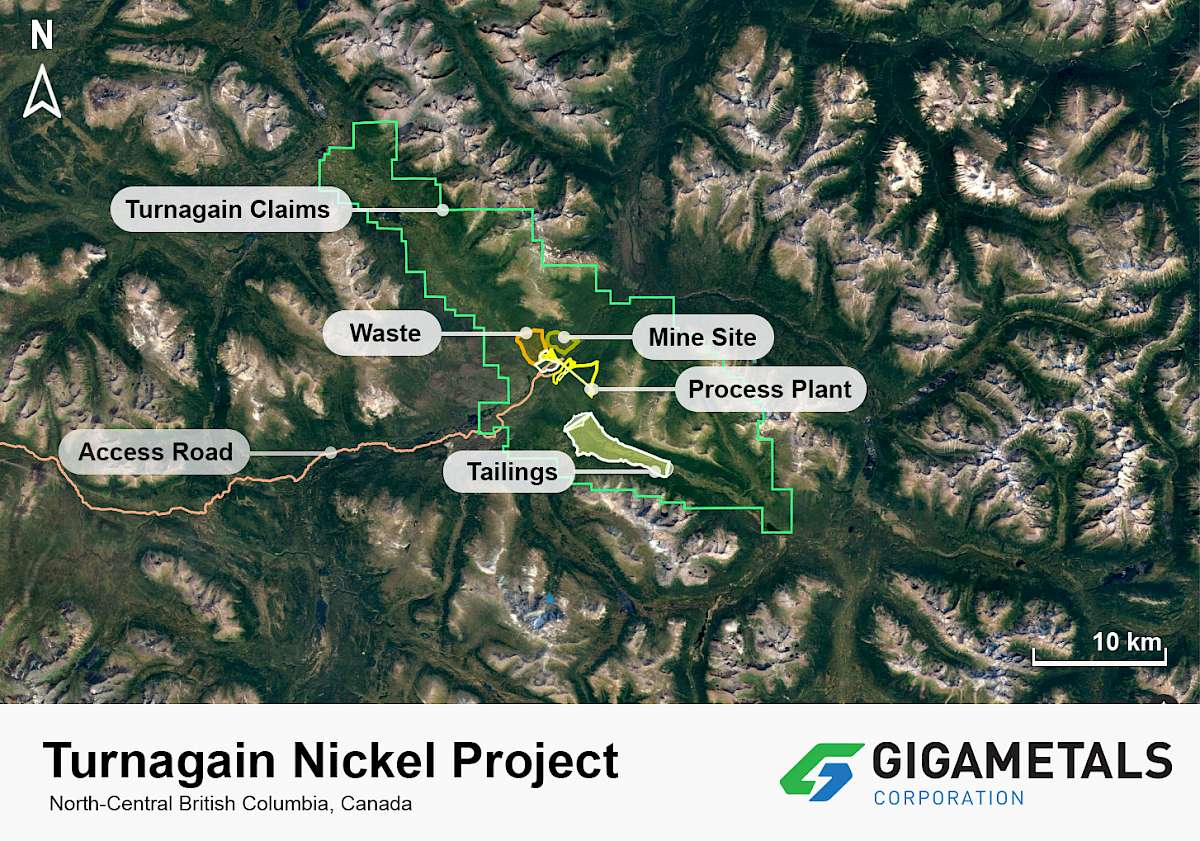

Turnagain Project Claims Map

Turnagain claims as of June 2022 with the major project elements from the 2020 PEA overlaid

Property Geology

The Turnagain Nickel property covers the known extent of a zoned, Alaskan-type ultramafic intrusive complex in fault contact with Paleozoic to Early Mesozoic graphitic sedimentary rocks along its northern and eastern margins. The southern contact is not exposed, but several drill holes have penetrated the contact and intersected deformed, graphitic phyllites in fault contact with the ultramafic complex.

The Turnagain intrusion comprises a central core of dunite with bounding units of wehrlite, olivine clinopyroxenite, clinopyroxenite, hornblende clinopyroxenite, and hornblendite. The complex is elongate and broadly conformable to the northwesterly-trending regional structural grain.

The ultramafic rocks are generally fresh to mildly serpentinized; however, more intense serpentinization and talc-carbonate alteration are common along faults and restricted zones within the complex. The central part of the ultramafic body is intruded by granodiorite to diorite, and hornblende–plagioclase porphyry dikes and sills.

The sulfide mineralisation, which is unusual for an Alaskan-type intrusion, is thought to be associated with meta-sediment wall-rock inclusions which provided the sulphur source. The sulfides are mainly pentlandite and pyrrhotite with minor amounts of chalcopyrite and pyrite, and trace bornite. Anomalous levels of platinum and palladium are also present; however, they are not considered economic at this time.

Drilling

The Turnagain drill hole database contains 382 drill holes totaling 97,345 m of drilling since 1967. The most recent resource drilling campaign was 2021, in which 15 drill holes totaling 6,295 m were completed to further characterize the resource, provide geotechnical information, and to collect metallurgical sample. Five geotechnical drill holes were completed in the intended tailings management area during 2022.

Two hundred and fifty-four (254) holes were used to calculate the 2023 resource. Some of the excluded holes are historic and lack usable analytical results, but approximately 80 of them have defined additional areas of nickel-copper-cobalt and PGE mineralization in other target areas of the ultramafic complex. Nickel-copper-cobalt mineralization similar to that found in the Horsetrail-Northwest Resource Zones has been intersected in two zones on the opposite side of the Turnagain River, namely the Hatzl and Cliff Zones, as well as near the northern margin of the ultramafic, at higher elevation in the Highland Zone. Furthermore, mapped dunite and wehrlite north of the Horsetrail-Northwest Resource Zones leaves the known resource open both across the river and to the north.

Qualified Persons

The above technical information and all the other technical information on this website pertaining to geology and drill hole data has been reviewed and approved by Greg Ross, P. Geo., Giga Metals’ Turnagain Project Manager, and a Qualified Person under NI 43-101. Technical information pertaining to project execution has been reviewed and approved by Lyle Trytten, P.Eng., a Qualified Person under NI43-101.