(Vancouver, B.C.) The year 2018 will be transformative for Giga Metals (TSX.V – GIGA). We are well funded, having raised more than $5 million in the last several months. We are planning a major drill campaign for the summer, and our technical team has begun internal engineering studies with the goal of making our project shovel ready by 2021.

Our Turnagain nickel/cobalt project hosts a NI 43-101 resource containing 4.1 billion pounds of nickel and 252 million pounds of cobalt in the measured and indicated categories, plus a further 4.3 billion pounds of nickel and 279 million pounds of cobalt in the inferred resource category, with less than 25% of the prospective nickel geology drilled.

Extensive metallurgical work on our project, reported in our 2011 PEA, has shown that we can reliably create a clean concentrate grading 18% nickel and 1% cobalt, and that we can create this concentrate with a simple processing circuit using off-the-shelf, tried and true technology. The concentrate would be sold to smelters to be refined to class one nickel, which is required by battery manufacturers.

Although nickel prices have only started to recover from multi-year lows, we are increasingly confident that prices must go significantly higher due to demand for battery materials sparked by the Electric Vehicle (EV) revolution. EV penetration rates are growing more quickly than anyone had imagined, and both nickel and cobalt are vital components of the lithium ion batteries that power the green revolution.

The drilling campaign we are planning has three components.

Delineation drilling within the first three phases of mining outlined in our December 2011 Preliminary Economic Assessment (PEA) is designed to upgrade, in accordance with 43-101 standards, the small amount of resources in those areas currently classified as Inferred Resources to Measured or Indicated Resources. If successful, the rerating will enable us to advance our engineering studies to pre-feasibility and then to the feasibility stage.

Step-out drilling from the known deposit is designed to increase the resource and may also lead to discovery of more starter pits, like the two already known, where higher than average grade comes right to surface.

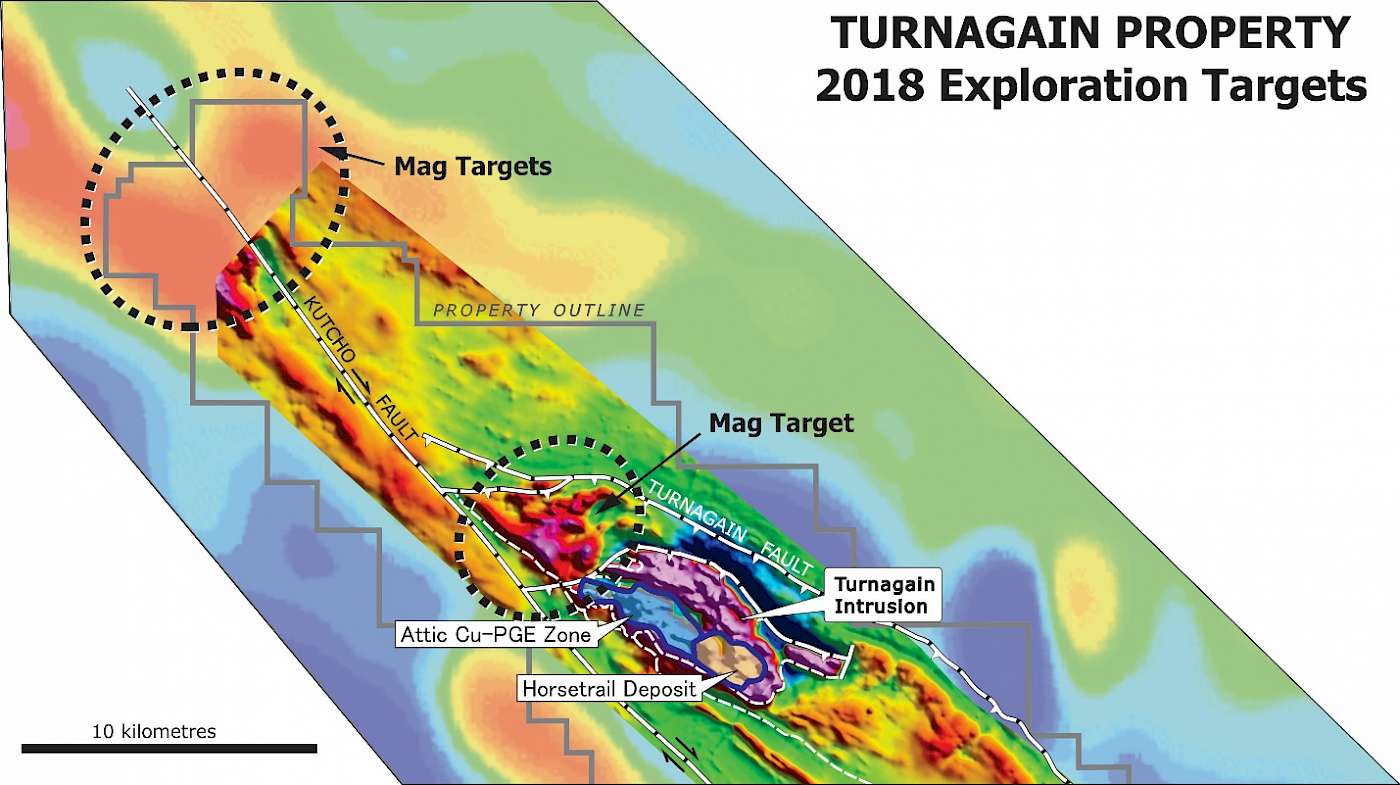

We are also planning exploration drilling on high impact target areas. Our geologists have yet to identify the roots of the ultramafic magmatic intrusive complex that hosts the Horsetrail deposit. The roots of this type of system include feeder zones that can contain high grade massive sulphides. It is postulated that these roots were faulted off from the main intrusive complex and transported somewhere else. So where could this part of the system have gone?

Magnetic surveys show three large magnetic anomalies to the northwest of the main Turnagain intrusive complex that could be fault offset sections of mineralized ultramafic rocks. Located where there is either no bedrock exposure or the observed bedrock exposures do not explain the elevated magnetic response, these anomalies represent “blind” targets that have never been tested. We plan to test them with a drill this summer.

Every day seems to bring further news about the accelerating penetration of Electric Vehicles in the automotive market, spending plans from car manufacturers and government initiatives regarding EV’s. With immense resources of nickel and cobalt, we are sitting in the sweet spot of a fundamentals-driven commodity cycle that looks set to last for decades. I look forward to the many milestones our company will achieve this year and beyond.

Mark Jarvis, President

January 2018

Scientific and technical information disclosed in this document has been reviewed and approved by David Tupper, P. Geo., a Qualified Person consistent with NI 43-101.

This document includes the use of inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. We also use the terms “measured” and “indicated” resources. We advise U.S. investors that, while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories would ever be converted to reserves.