Vancouver, B.C. – Giga Metals Corp. (TSX VENTURE: GIGA) ( “Giga Metals” or the “Company”) today announced the results of a preliminary economic assessment (“PEA”) prepared in accordance with National Instrument 43-101 (“NI 43-101”) for the Turnagain Nickel-Cobalt Project (“Turnagain”) located 65 km east of Dease Lake in British Columbia, Canada. The PEA is an update of the 2011 PEA confirming the ability of Turnagain to produce high-quality nickel concentrate, such as that needed to make pure nickel products for the electric vehicle (EV) market, in a socially and environmentally responsible manner. The PEA has been prepared by Hatch Ltd, a global engineering company with substantial expertise in the mining sector, with input from Hatch personnel and industry expert consultants including Wood Mackenzie (nickel and cobalt markets, smelter terms), Blue Coast Metallurgy (process design), Knight Piésold (tailings and water management), Kerr Wood Leidal (power supply and costs), and Kirkham Geosystems (resource model and estimates). Giga Metals’ primary driver for this update was to deliver a reliable and comprehensive PEA incorporating all project-related components for use for discussion with strategic investors, for targeting improvement opportunities, and to serve as a base for future engineering studies.

Summary

The PEA indicates a long-life, large-scale project. With a projected build capital of US$1.4B (Phase 1) and US$0.5B (Phase 2) including significant investment for a powerline delivering low-cost, clean, low-carbon power from BC Hydro (mainly hydroelectric), the projected capital intensity is US$51,500 per annual tonne nickel at full rates (years 6 to 20).

At full rate (years 6 to 20), the project is expected to deliver 37,149 tonnes per year of nickel in a high-grade nickel concentrate at an operating cost of US$3.20/lb nickel before by-product credits at the plant gate (all production data are metal in produced concentrate), or US$3.04/lb nickel after credits and shipping (in concentrate, delivered CIF Asia port). At metals prices of U.S. $7.50 per pound of nickel and smelter terms of 78% NSR as provided by Wood Mackenzie, Turnagain is expected to have a pre-tax IRR of 6.3%. At the environmental, social, and governance (ESG)-premium pricing1 case, the project is expected to have a pre-tax IRR of 9.4%. The base case pricing is based on a relatively conservative EV demand forecast creating a nickel shortfall after 2030 growing to 1.3 Mt/y by 2040. This projected deficit requires more than 35 Turnagain-scale projects to fill.

Based on the resources previously disclosed (Sep 19, 2019) including 1.07 billion tonnes of Measured and Indicated and 1.1 billion tonnes of Inferred (respectively, 5.2 billion pounds and 5.5 billion pounds of nickel content), the project is expected to operate for at least 35 years, producing 1.2 million tonnes of nickel-in-concentrate at an average grade of 18% nickel and 1% cobalt, comparable to the best nickel concentrates currently produced in the world.

At this stage, the PEA does not include valuation of potentially significant opportunities identified such as carbon sequestration from the waste residue (tailings) to be deposited in the Tailings Management Facility (TMF). The Company is actively working on quantifying carbon dioxide (CO2) sequestration rates through independent scientific research currently ongoing at the University of British Columbia by Dr. Greg Dipple. Giga Metals is targeting to minimize the greenhouse gas (GHG) footprint of the Turnagain mine once operational and CO2 sequestration by the TMF is expected to help achieve the goal of CO2 neutrality in future years.

Turnagain PEA Overview

The PEA was prepared by Hatch Ltd, a global engineering company with substantial expertise in the mining and metals sectors, with input from industry expert consultants including Kirkham Geosystems (resource model and estimates), Blue Coast Metallurgy (process design), Knight Piésold (tailings and water management), Kerr Wood Leidal (power supply and costs), and Wood Mackenzie (nickel and cobalt markets, smelter terms). For more details, see the Qualified Persons section below.

The PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and, as such, there is no certainty that the PEA results will be realized.

Highlights (all currencies are reported in US dollars):

- Notable ESG credentials

- Production of nickel in concentrate at a very low GHG intensity of <2.5 t CO2e/t Ni (base case – diesel haul fleet), with potential reduction to <1 t CO2e/t Ni with the use of electrified haul equipment when it becomes available

- Efficient tailings storage potential in sub-aerial valley impoundment, allowing natural sequestration of CO2 through mineral carbonation

- Excellent water balance, operates in a near-neutral water balance for most of the mine life

- Located in well-regulated developed jurisdiction that has adopted First Nations’ rights to informed consent into permitting processes

- Production of clean, high-grade nickel sulphide concentrate (18% nickel, 1% cobalt) with no impurities at deleterious levels

- Competitive costing with large greenfield nickel development

- Capital cost for Phase 1 of US$1.4B inclusive of construction and owners costs, comprised of US$1.1B plus power line construction at US$0.3B, with expansion in Year 6 at US$0.5B, taking production to 37 kt/y Ni

- Life-of-mine operating cost at US$2.81/lb Ni delivered to plant gate, net of by-product credits

- Industry standard processing with current smelting and refining charges delivers pre-tax IRR of 6.3% at base case pricing of US$7.50/lb Ni and 9.4% at ESG-premium pricing case of US$8.50/lb Ni

PEA Assumptions and Economic Results

The PEA is based on a set of assumptions and calculated results. The major values are indicated in the table below. Average values are annual or weight-averaged by mill feed or nickel production, as appropriate. All costs are presented in US$. Site operating costs including all direct operating costs and G&A. Net operating costs below are inclusive of transport to port (assumed Asia) and expected net payment for contained cobalt. Construction capital costs include off-site infrastructure (high-voltage power line for connection to existing provincial power supply grid, access road). Sustaining capital costs include allowances for ongoing TMF development, mining equipment, plant capital equipment replacement, closure related costs, and costs for access to the BC Northwest Transmission Line (for clean low-carbon power supply). All costs are estimated using an exchange rate of C$1.30 = US$1.00.

| All parameters annual average except capital and sustaining capital cost |

Phase 1 (Y1-5) Average |

Phase 2 (Y6-20) Average |

Phase 2 (Y21-37) Average |

LOM (Y1-37) Average |

LOM (Y1-37) Total |

|---|---|---|---|---|---|

| Ore Processed (Mt) | 15.3 | 32.7 | 32.6 | 30.3 | 1,122 |

| Nickel Grade (%) | 0.260 | 0.220 | 0.216 | 0.221 | -- |

| Nickel Recovery (%) | 57.3 | 51.6 | 46.5 | 49.6 | -- |

| Nickel Production (t in concentrate) | 22,754 | 37,149 | 32,821 | 33,215 | 1,228,961 |

| Cobalt Production (t in concentrate) | 1,379 | 2,224 | 1,902 | 1,962 | 72,592 |

| Nickel Price ($/lb) and Payability | $7.50 / 78% | ||||

| Cobalt Price ($/lb) and Payability | $22.30 / 35% | ||||

| Revenue ($M) | $317 | $517 | $456 | $462 | $17,099 |

| Site Operating Cost | $8,852 | ||||

| ($/t ore) | $9.63 | $7.99 | $7.56 | $7.89 | -- |

| ($/lb Ni) | $2.93 | $3.20 | $3.41 | $3.27 | -- |

| Net Operating Cost ($/lb Ni) | $2.77 | $3.04 | $3.27 | $3.12 | -- |

| Capital Cost (construction, $M)** | $1,381 | $532 | $1,913 | ||

| Sustaining Capital ($M), including closure obligations** |

$274 | $1,011 | $715* | $2,000 | |

* Includes $2.8M in TMF and closure costs in Year 38

** Total, not average

Sensitivity Analysis

The economic analysis for the project with a variety of primary sensitivities is shown in the table below. All values are pre-tax, in US$.

| Parameter Value | NPV (8%, $M) | Pre-tax IRR | |

|---|---|---|---|

| Base Case | (269) | 6.3% | |

| ESG Incentive Price | $8.50/lb Ni | 242 | 9.4% |

| Phase 1 Capital Costs (+/-20%) | $1,657 / $1,104 | (507) / (31) | 5.2% / 7.8% |

| Phase 2 Capital Costs (+/ -20%) | $639 / $426 | (330) / (208) | 6.0% / 6.7% |

| Sustaining Capital Costs (+/-20%) | (379) / (159) | 5.6% / 7.0% | |

| Site Operating Cost (+/-20%)* | $3.92 / $2.61/lb Ni | (694) / 156 | 3.2 % / 8.9% |

| Nickel Payment | 70% / 75% | (663) / (417) | 3.5% /5.3% |

| Exchange Rate | $0.70 / $0.80 | 39 / (408) | 8.2% / 5.5% |

*factor applied across all years; LOM value shown for parameter value

Revenues

Revenues are based on a market study completed by Wood Mackenzie (WM). WM forecasts a significant nickel deficit beginning 2029, particularly for Class 1 nickel for EV/ESS battery uses. The total nickel market demand growth is estimated to require 133 kt/y of new supply by 2030 and 1,300 kt/y by 2040. This demand growth requires nickel producers to bring on an additional capacity in the 2030-2040 timeframe greater than three Turnagain projects every year. Following the significant contraction in nickel markets in early 2020, WM has revised their long-term incentive nickel price downwards from US$9.00/lb to US$7.50/lb, while acknowledging that the growing ESG pressures in the EV industry could lead to a higher incentive price of US$8.50/lb to bring on suitable projects.

WM does not forecast cobalt price to move dramatically despite predicted shortfalls; as cobalt is primarily a by-product from nickel and copper production, WM bases their forecast on inflation-adjusted pricing, with a price of US$22.30/lb.

WM has reviewed smelter operations globally and notes seven smelters currently procuring third-party concentrates and shortfalls in concentrate supply beginning 2025 and increasing to 130 kt/y nickel content by 2030. Recommended smelter payment terms for nickel concentrate are 78% of contained nickel and 35% of contained cobalt. The PEA includes a downside sensitivity range below this level. No benefit has been assumed for the high-grade of Turnagain nickel concentrate; at 18% nickel, the concentrate is higher-grade than other commercial nickel concentrates2.

Nickel concentrates with low precious metal and platinum group metal by-product value, similar to Turnagain, have been successfully directly refined to Class 1 nickel by Sherritt Gordon Mines Ltd (now Sherritt International, at Fort Saskatchewan, Alberta, Canada), by Western Mining Corporation (now BHP, at Kwinana, Western Australia), and most recently by Vale at Long Harbour, Newfoundland. Prior work on hydrometallurgical treatment of Turnagain concentrates suggests that the material is amenable to this processing approach as well as the standard smelting and refining assumed for the market study. Hydrometallurgical refining could lead to improved payment terms compared to standard treatment charges from smelting and would allow the recovery of nickel and cobalt in metal or sulphate form, should this process route be pursued by potential customers. No recent PEA level technical and financial analysis has been completed for Turnagain concentrate to determine the economic viability of this alternative.

Operating Cost

The operating cost estimate for the project has been developed by Hatch with specialized input from independent contractors including Knight Piésold (tailings and water management), Kerr Wood Leidal (power), and Blue Coast Metallurgy (reagent consumption). The site operating cost estimate is shown below, in US$/t ore feed with the final values converted to US$/lb nickel production. Concentrate shipping is added on, estimated at US$113/wmt concentrate (wet metric tonne, based on CIF delivery to main port Asia) and cobalt credits subtracted to develop the net operating cost.

| Operating Cost Summary | Phase 1 (Y1-5) |

Phase 2 (Y6-20) |

Phase 2 (Y21-37) |

LoM |

|---|---|---|---|---|

| Mining | 3.52 | 2.89 | 2.46 | 2.72 |

| Processing and site infrastructure | 4.90 | 4.39 | 4.38 | 4.42 |

| G&A | 1.13 | 0.68 | 0.68 | 0.71 |

| Electrical supply O&M | 0.08 | 0.04 | 0.04 | 0.04 |

| Site operating cost ($/t ore) | 9.63 | 7.99 | 7.56 | 7.89 |

| Site operating cost ($/lb Ni) | 2.93 | 3.20 | 3.41 | 3.27 |

| Concentrate shipping ($/lb Ni) | 0.31 | 0.31 | 0.31 | 0.31 |

| By-product credits ($/lb Ni) | -0.47 | -0.47 | -0.45 | -0.46 |

| Net operating cost ($/lb Ni) | 2.77 | 3.04 | 3.27 | 3.12 |

Capital Cost

The capital cost estimate for the project has been developed by Hatch with specialized input from independent contractors including Knight Piésold (tailings and water management) and Kerr Wood Leidal (power line). The cost estimate is shown below. All costs are presented in US$M. The cost estimate is Class 5, with expected accuracy of +50%/-30%.

| Item | Phase 1 | Phase 2 | LoM |

|---|---|---|---|

| Mine directs | 133 | 45 | 178 |

| Process plant directs | 307 | 245 | 551 |

| Tailings storage facility directs | 87 | 20 | 107 |

| On-site infrastructure directs | 77 | - | 77 |

| Indirects | 204 | 104 | 308 |

| Contingency | 191 | 99 | 290 |

| Owner's cost and EA | 63 | 20 | 83 |

| Electrical supply | 278 | - | 278 |

| Site access road | 42 | - | 42 |

| Total initial/expansion capital | 1,381 | 532 | 1,913 |

Sustaining capital for the project, including ongoing TMF construction (dam lifts), mining equipment, and an allowance for process plant and site infrastructure upgrades is shown below, along with the estimated life of mine closure and reclamation bonding costs. There is currently a tariff supplement applied by BC Hydro for access to the Northwest Transmission Line; per current BC Hydro regulations, a 5-yr payment term is applied for each phase of the project. Giga Metals has been advised that this tariff supplement is under review for possible removal.

| Item | Phase 1 (Y1-5) |

Phase 2 (Y6-20) |

Phase 2 (Y21-37) |

LoM |

|---|---|---|---|---|

| Mine | 0 | 348 | 148 | 496 |

| Process plant | 31 | 165 | 187 | 384 |

| Tailings storage facility | 107 | 377 | 335 | 819 |

| On-site infrastructure | 8 | 23 | 26 | 57 |

| Electrical supply: Tariff Supplement 37 | 90 | 82 | - | 172 |

| Total sustaining capital | 236 | 996 | 697 | 1,928 |

| Closure and reclamation | 38 | 15 | 18 | 72 |

| Total sustaining capital and closure and reclamation |

274 | 1,011 | 715* | 2,000 |

* Includes $2.8M in TMF and closure costs in Year 38

PEA Major Components

Geology and Mineralogy

The Turnagain Project is located in the Turnagain ultramafic complex, which comprises a central core of dunite with bounding units of primarily wehrlite, olivine clinopyroxenite, clinopyroxenite, and hornblendite. The complex is elongate and broadly conformable to the northwesterly-trending regional structural grain. The ultramafic rocks are partially serpentinized on a mineral grain scale, while more intense serpentinization and talc-carbonate alteration occur along faults and restricted zones within the complex. The central part of the ultramafic body is intruded by granodiorite to diorite, and hornblende–plagioclase porphyry dikes and sills.

Showings of semi-massive and massive sulphides have been identified by work to date. These semi-massive and massive zones, plus broad zones of disseminated sulphides, are generally hosted by dunite and wehrlite near the southern and eastern margins of the ultramafic body. Primary sulphide minerals consist of pyrrhotite and pentlandite with minor chalcopyrite. Interstitial and blebby sulphides, with grain sizes ranging from 1 mm to 4 mm, are evident in widespread disseminated zones seen in drill cores.

Minor amounts of fibrous serpentine minerals (i.e. asbestiform minerals) have been detected in many Turnagain samples, consistent with alteration of ultramafic host rocks. This is a common feature for ultramafic-hosted nickel deposits.

Mineral Resource Estimate

As previously released by Giga Metals (Sept 19, 2019), the base case mineral resource estimate for the Turnagain Nickel-Cobalt Project is as follows. This resource estimate has not been updated for the current PEA base case study, which includes revised nickel price and payability values.

Turnagain Nickel-Cobalt Project Mineral Resource Summary1,2,3,4,5

| Resource | Tonnes | Ni Grade | Contained Ni | Co Grade | Contained Co |

|---|---|---|---|---|---|

| Classification | (000 t) | (%) | (000 lb) | (%) | (000 lb) |

| Measured | 360,913 | 0.230 | 1,832,440 | 0.014 | 109,803 |

| Indicated | 712,406 | 0.215 | 3,373,616 | 0.013 | 202,605 |

| Measured and Indicated | 1,073,319 | 0.220 | 5,206,056 | 0.013 | 312,409 |

| Inferred4 | 1,142,101 | 0.217 | 5,473,909 | 0.013 | 327,327 |

(1) All mineral resources have been estimated in accordance with Canadian Institute of Mining and Metallurgy and Petroleum (“CIM”) definitions, as required under National Instrument 43-101 (“NI 43-101”).

(2) Mineral resources are reported in relation to a conceptual pit shell in order to demonstrate reasonable expectation of eventual economic extraction, as required under NI 43-101; mineralization lying outside of these pit shells is not reported as a mineral resource. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

(3) Mineral resources are reported at a cut-off grade of 0.1% Ni. Cut-off grades are based on a price of US $8.50 per pound and a number of operating cost and recovery assumptions, plus a contingency as reported in the December 2011 PEA authored by AMC Consulting.

(4) Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. However, it is reasonably expected that the majority of Inferred mineral resources could be upgraded to Indicated.

(5) Due to rounding, numbers presented may not add up precisely to the totals provided and percentages my not precisely reflect absolute figures.

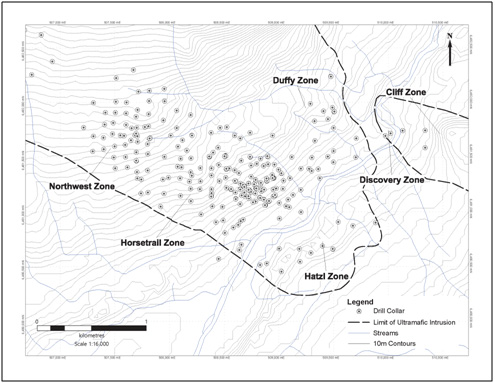

The mineral resources are contained in a large, contiguous, near-surface deposit amenable to large-scale open-pit mining techniques. This mineral resource is based on a database of 362 drill holes totalling 90,635 m of drilling, conducted from 2002 through 2018. The distribution of drill holes is shown in the figure below.

Source: Kirkham, 2020

Metallurgy

Numerous phases of testing have been conducted on Turnagain samples over the past two decades. Since 2011, work has focused on the production of high-grade nickel sulphide concentrates. The initial work mostly used material drilled from the south end of the Horsetrail zone however more recent work has been conducted on samples from throughout the Horsetrail and Northwest zones which are the focus of the current mine plan.

Comminution

Samples from the Turnagain deposit have undergone extensive small-scale comminution testing including crushing, semi-autogenous grinding (SAG), high-pressure grinding roll (HPGR, via piston press testing), milling (Bond ball and rod), and abrasion. Turnagain material is hard, with a mean Bond Ball Mill Work Index of 19.8 kWh/tonne. The SAG Axb hardness of the 15th percentile material is 23.0 which indicates Turnagain is highly resistant to SAG milling. This makes HPGR a favorable comminution technology for the project.

Mineralogy

The host rock is comprised of serpentine (≈40%), olivine (≈35%) and clinopyroxene (≈10%). Ratios of serpentine to olivine vary across the deposit, with the total remaining near 75%. Talc was essentially absent from about 95% of the samples analyzed, with the median content being 0.01%.

Nickel occurs in both sulphide and non-sulphide form, with typically 65-70% of the nickel in the sulphide form; the fraction of nickel in the sulphide form is related to the sulphur content of the host rocks. More than 99% of the sulphide nickel is hosted in pentlandite, with pyrrhotite hosting less than 1% of the nickel. Non-sulphide nickel is mostly hosted in olivine and serpentine. There is considerable local variability in nickel deportment between pentlandite and non-sulphide forms and this is the primary driver behind nickel recovery to concentrate. The pentlandite grain size is also quite widely distributed; fine grained pentlandite is only adequately liberated at grind sizes (P80) of well below 100 µm.

Mineral Recovery

The Turnagain material has been shown to be amenable to simple froth flotation, yielding high recoveries of the liberated sulphide minerals to high-grade concentrates. The flotation flowsheet adopted for this study includes primary grinding to 80% passing 85 µm, rougher flotation, three stages of cleaner flotation, and a cleaner-scavenger flotation step. Reagents are simple and conventional for nickel flotation, including a collector, dispersant, and frother. High selectivity has been achieved between pentlandite and pyrrhotite, and combined with high gangue rejection, high-grade nickel concentrates are consistently achieved.

Numerous locked cycle tests have been conducted on Turnagain samples; ten tests using variations of the selected flowsheet have yielded concentrate grades averaging 19.3% nickel (15.3% to 21.4% nickel) with average nickel recovery of 58%. Concentrate assays averaged 1.2% cobalt, 4.4% magnesium, 32% iron, and 26% sulphur, with minor copper, palladium and platinum (0.5%, 2 g/t, and 1.1 g/t, respectively). The concentrate fits within normal smelter parameters, with an MgO level of 7.3% and an Fe:MgO ratio of 4.4. No minor elements were identified that are believed to be deleterious.

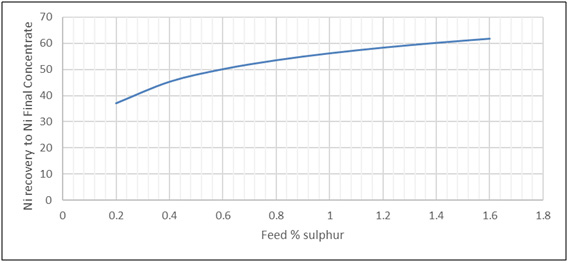

Since 2009 some five different variability studies have been conducted on project samples. Each of these studies revealed a link between rougher nickel recovery and the sulphur head grade. Combined with locked-cycle cleaner data, the expected total nickel recovery as a function of sulphur is shown below.

Source: Blue Coast Metallurgy, 2020

Mining

The Turnagain deposit will be mined using open pit mining methods, employing high volume trucks and shovels to minimize unit costs. For the purpose of this study, the Horsetrail Pits are scheduled for a 31 year mine production period, and includes the Horsetrail, Northwest, and Duffy mineralized zones, split into one primary pit and a smaller shell located just outside the periphery to the northeast. Overall main pit dimensions are ~2 km x 1 km, with an area of 200 ha.

The mineral resources contained and scheduled in the Horsetrail Pits is summarized below.

| Mineralization (Mt) |

Waste (Mt) |

Strip Ratio (t/t) |

Ni (%) |

Co (%) |

S (%) |

|

|---|---|---|---|---|---|---|

| Total / Average | 1,122 | 208 | 0.19 | 0.221 | 0.013 | 0.60 |

Note: includes Inferred Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that these data will be realized

The mine plan is developed in line with planned phasing of operations, with an annual mill feed rate of 16.4 Mtpy (equivalent to 45 ktpd) for Phase 1, doubling in Year 6 to 32.8 Mtpy for Phase 2. The resource will be mined for a total of 31 years, with a further 6 years of operation recovering 194 Mt of material from lower-grade stockpiles.

To access the most economic mineralization in the early years and provide a smooth strip ratio throughout the life of mine, mining is scheduled in five mining stages. Stage 1 will commence at the centre of the Horsetrail zone, where the highest mineralization grade and lowest strip ratio will be encountered. Elevated cut-off grades will be employed in the initial production and through most of the mining life to enhance the economics of the project; lower-grade mineralized material will be sent to stockpile in a joint waste and low grade stockpile facility. Low-grade stockpiled material will be reclaimed at the end of the mine life or blended with the run-of-mine feed if the opportunity exists.

Current geochemistry data suggests that there is insignificant acid generating potential in the waste and low-grade material.

Processing

As noted in the metallurgy section, processing of Turnagain ore is straightforward. At full rates, the process plant will consist of:

- One primary crusher followed by two trains of secondary crushing and HPGRs

- Two grinding trains, each comprising two ball mills in series

- Four parallel banks of mechanical cell rougher flotation (two banks per train)

- Two parallel lines of three-stage mechanical cell cleaner circuits plus mechanical cell cleaner-scavenger flotation

- Concentrate thickening and filtration

This circuit lends itself well to the two-phase development plan, twinning all but the primary crusher. During the first phase of operation, the primary crusher will operate at reduced rates. The crushing and HPGR circuits are located adjacent to the mine to reduce haul distances, with the crushed ore conveyed to the mill site across the Turnagain River above the Flat Creek valley. This allows for energy-efficient conveying of ore and minimizes high-pressure pumping of slurries. All process facilities and stockpiles after initial crushing are enclosed and equipped with dust collection to minimize both hygiene and environmental impacts.

Infrastructure

On-site

The site will include all necessary infrastructure for operation of the facility, including a camp for workers (rotational basis); administration, lab, fuel distribution, and maintenance facilities; and waste management facilities.

As noted in prior sections, waste rock and low-grade material will be placed in a stockpile located near the mine. Tailings will be deposited in an engineered TMF, currently planned for the Flat Creek valley near the process plant.

Water runoff from the stockpile, seepage from the TMF, and pit water will be collected for re-use or disposal, as appropriate. Water intercepts will be used above the TMF, stockpile, and pit to divert water around the areas for return to the environment.

Buildings will be of modular construction wherever possible (camp, administration, change facilities, etc.). Larger facilities such as the truck shop and maintenance building will be stick-built. Sewage and domestic waste will be treated in onsite facilities.

Off-site

Primary off-site infrastructure requirements are an access road and BC Hydro transmission line extension to connect the mine to BC Hydro.

The PEA has allowed for substantial upgrades to the existing Boulder access trail which provides an approximate 78 km approach from Dease Lake to the project site. Further work will determine ultimate route alignment; an opportunity to avoid two crossings of the Turnagain River has been identified by keeping the access road on the north bank for the last 16 km past the existing Boulder City crossing of the Turnagain River. There may be an opportunity to co-operate on road development with other potential mine operators in the region.

The PEA has also allowed for a fully-funded extension of the existing 287 kV Northwest Transmission Line to the project site, a distance of approximately 160 km. This will deliver clean low-carbon electricity to the project, allowing the production of nickel in concentrate with a very low GHG footprint. Depending on BC Hydro power availability and plans, the extended power line could provide opportunity for tie-in to local communities, and for further economic development in the mineral-rich northwest quadrant of British Columbia, key potential benefits for the local communities.

The power study also evaluated renewable power options in the area, and supply of power from a dedicated liquefied natural gas-fueled power plant. Local renewable power options are not favourable in competition with BC Hydro supply. An LNG-fuelled power plant and hybrid options are possible but are currently evaluated to be less economic than the selected alternative and will result in a higher GHG footprint.

Giga Metals intends to evaluate potential funding, partnership, and co-operation opportunities for the off-site infrastructure to ensure sharing of benefits and costs.

Social and Environment

The Turnagain project is located in the traditional territories of the Tahltan and Kaska Dena, just east of the Treaty 8 western boundary. Giga Metals has established positive engagements with the Tahltan Central Government and Kaska Dena Council and will continue respectful and ongoing engagements with the local First Nations. British Columbia has recently enacted the United Nations Declaration on the Rights of Indigenous People (UNDRIP), aligning with updated federal review processes requiring informed consent.

British Columbia and Canada have robust environmental permitting processes including assessment of environmental and social impacts. The project is expected to be subject to both provincial and federal reviews of an environment impact assessment (EIA), which should be conducted in one review process through a substitution agreement between the provincial and federal agencies. This process will involve consultations with the public and First Nations, as well as detailed studies of baseline environmental settings and an assessment of potential project impacts. Baseline environmental studies to support the EIA process were initiated in 2004 and are ongoing.

Tailings Management

Tailings management options have been reviewed by Knight Piésold, and the Flat Creek Valley adjacent to the selected processing site has been selected as the primary candidate for the TMF. The near end of the TMF is approximately 1.5 km from the processing facility. The location offers a good balance of minimal water disturbance, good life-of-mine water balance, ability to safely store tailings for the proposed life of mine (and additional inferred resources, if required), and storage efficiency. Further work will be required to complete a more thorough tailings alternatives assessment, including discussions with local communities and regulators.

The tailings dam construction is planned by the center-line method, using primarily purposely-quarried material to ensure that dam construction is not negatively impacted by the sequencing of construction and mining operations. If suitable mine waste material is available for TMF raises, it may be used to reduce the quantity of both purposeful quarrying and end-of-life waste rock storage, reducing overall project footprint.

Tailings will flow to the TMF as a slurry by gravity, to reduce overall power consumption and reduce the potential for tailings spills from high-pressure pipelines. The TMF will be operated initially as a sub-aqueous facility to ensure sufficient water retention for process plant operation but will quickly transition to a sub-aerial facility as the tailings footprint increases, while maintaining sufficient water retention for recycle to the process plant. This will ensure the driest and most stable TMF possible that is consistent with large-scale, low-grade mining in the Turnagain climate.

Tailings from the project are expected to be relatively benign, with a high neutralizing potential indicating a low likelihood of acid rock drainage. Material identified to have potential for reactivity will be co-placed with high neutralizing potential material to minimize any migration of metals.

Ultramafic tailings are known to be reactive with carbon dioxide in the atmosphere, transforming magnesium silicates and hydroxides into magnesium carbonates and effectively sequestering carbon dioxide. This process also strengthens the deposited tailings. Giga Metals is sponsoring ongoing research into the carbonation behaviour of Turnagain ores, to further develop methods of improving and quantifying sequestration. The TMF design is consistent with the goal of maximizing carbon sequestration with Turnagain tailings.

Greenhouse Gas (GHG) Emissions

A strength of the Turnagain project is the opportunity for very low carbon emissions for the production of nickel in concentrate for conversion to EV batteries. EV manufacturers have expressed keen interest in clean, responsible battery metals. Through the PEA, Giga Metals has evaluated the GHG emissions for the project, and opportunities for improvement. The project is estimated to produce nickel with a GHG footprint (Scope 1 and Scope 2) of <2.5 t/t Ni over the project life. The majority of this (75%) is from the diesel usage in the mine, primarily for the haul fleet. Giga intends to evaluate options to reduce this component in future studies, including currently available technology such as trolley-assist and alternate fuels, as well as battery-electric or fuel-cell power vehicles which are under development. Preliminary estimates suggest that if the latter become commercially available, the Turnagain project could reduce GHG emissions to <1 t/t Ni over the project life.

As noted, Turnagain tailings are expected to be reactive with CO2 to sequester carbon permanently in the ground. With an electrified fleet and only moderate sequestration amounting to 25 t/ha/yr (0.8 kg/t tailings) in the TMF, Turnagain could be a carbon-neutral mine.

Opportunities and Further Work

Numerous opportunities for improvement have been identified, as well as some areas where further work is required to advance through a pre-feasibility study. The more relevant of these are highlighted below.

- Additional comminution and mineral recovery testwork

- Testwork has demonstrated potential to improve recoveries with a modified flowsheet, including separate high-grade and low-grade flotation and a regrind of the rougher concentrate

- The majority of the testwork to date has been on higher-sulphur material representing the early years of the resource. Additional testwork is required to validate the performance of lower-sulphur material, and to ensure that a robust geometallurgical model can be developed, which may offer opportunity to modify the mine plan to optimize production profile.

- Additional comminution testing, from crushing through grinding, will validate and refine the flowsheet design, and help develop a geometallurgical model which may offer opportunity to modify the mine plan to optimize operating cost profile.

- Additional site data collection

- Additional data to confirm geotechnical conditions and ensure appropriate design of site facilities, including mine pit, stockpiles, and tailings management facilities.

- Additional data to confirm hydrogeological conditions and ensure appropriate design of pit slopes and water collection systems. The current hydrogeological model features a number of assumptions that, although believed appropriate, require field confirmation.

- Additional climatic data and stream hydrology will better establish overall site water balance.

- Additional environmental data collection will help prepare for advancing an environmental assessment. This includes definition of baseline conditions.

- Tailings Management Facility Alternatives Assessment

- The chosen site was selected following a preliminary alternatives assessment and is believed to be a robust choice environmentally, technically, and economically. A more comprehensive study incorporating additional viewpoints and considerations (including local communities) will ensure that the TMF design and location is supported by all stakeholders.

- Engineering trade-off studies

- Utilization of run of mine waste for TMF buttress construction.

- Mine equipment analysis and optimization inclusive of automation, trolley assist and alternative energy systems, in-pit crushing, in-pit conveying.

- Expansion of mining targets inclusive of the Hatzl and eastern Horsetrail zones.

- Hydrometallurgical Processing Study

- Turnagain concentrate is high-grade, and past testwork has demonstrated the ability to leach the material into solution for direct refining to Class 1 nickel or battery-grade nickel sulphate, as has been demonstrated by other Canadian operators. The potential for hydrometallurgical refining to improve the project could be further investigated through proof-of-concept testing and a conceptual engineering study.

Qualified Persons

The PEA was conducted under the overall direction of Ian Thompson, P. Eng. of Hatch Ltd. Mr. Thompson is a Hatch mining engineer and an independent qualified person under NI 43-101 who has reviewed and approved the technical, scientific and economic information included in this news release.

The following persons are responsible for specific inputs into the PEA:

- Ian Thompson, P.Eng., Hatch: mining design criteria, mining capital and operating cost models and production scheduling

- Persio Rosario, P.Eng., Hatch: process facilities design and operating cost estimate

- Stefan Hlouschko, P.Eng., Hatch: economic analysis

- Garth Kirkham, P.Geo., Kirkham Geosystems Ltd.: geological modelling and resource estimation

- Chris Martin, C.Eng., Blue Coast Metallurgy Ltd: metallurgical testing and process design

- Andrew Mitchell, C.Eng., Wood Mackenzie: nickel and cobalt market analysis, prices, and smelter terms

- Daniel Friedman, P.Eng., Knight Piésold Ltd: TMF and site water management design and costing

- Ron Monk, M.Eng., P.Eng., Kerr Wood Leidal Associates Ltd: power supply options and cost estimates

About Giga Metals Corporation

Giga Metals Corporation is focused on metals critical to modern batteries, especially those used in Electric Vehicles and Energy Storage. The Company’s core asset is the Turnagain Project, located in northern British Columbia, which contains one of the few significant undeveloped sulphide nickel and cobalt resources in the world.

Forward looking statements

Certain statements in this news release are forward-looking statements, which reflect the expectations of management regarding the Turnagain Project. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such statements include, but are not limited to, statements with respect to the future financial or operating performance of the Company and its mineral projects, the estimation of mineral resources and mineral prices, steps to be taken towards commercialization of the resource, the timing and amount of estimated future production and capital, operating and exploration expenditures. Such statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. These forward-looking statements reflect management's current views and are based on certain expectations, estimates and assumptions which may prove to be incorrect, including the list of additional work prior to requisitioning a Pre-feasibility study, and statements relating to future exploration and development of the Project and mineral resource and mineral reserve estimations relating to the Project. A number of risks and uncertainties could cause our actual results to differ materially from those expressed or implied by the forward-looking statements, including: (1) the mineral resource estimates relating to the Project could prove to be inaccurate for any reason whatsoever, (2) Giga is unable to finance the Project, (3) prices for nickel and cobalt or project costs could differ substantially and make any commercialization uneconomic, (4) inferred and indicated resources may not materialize, (5) permits, environmental opposition, government regulation, cost overruns or any of many other factors may prevent the Company from commercializing the Turnagain Project, (6) additional but currently unforeseen work may be required to advance to the pre-feasibility stage, and (7) even if the Project goes into production, there is no assurance that operations will be profitable. These forward-looking statements are made as of the date of this news release and, except as required by applicable securities laws, the Company assumes no obligation to update these forward-looking statements, or to update the reasons why actual results differed from those projected in the forward-looking statements. Additional information about these and other assumptions, risks and uncertainties are set out in the "Risks and Uncertainties" section in the Company's most recent MD&A filed with Canadian security regulators.

On behalf of the Board of Directors,

MARK JARVIS

CEO

Tel - 604 681 2300

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

1 The ESG premium case is based on an anticipated premium for nickel produced with low carbon emissions and in accordance with best practices relating to tailings management, environmental regulation and practice, treatment of workers and communities, and governance practices, as desired by customers who are looking to position themselves as sustainable producers.

2 Crundwell et al; Extractive Metallurgy of Nickel, Cobalt, and Platinum-Group Metals, Chapter 15; Elsevier; 2011